All Categories

Featured

Table of Contents

- – What is a simple explanation of Level Term Lif...

- – How much does No Medical Exam Level Term Life ...

- – Is Level Term Life Insurance Benefits worth it?

- – What is a simple explanation of Affordable Le...

- – What are the top Level Term Life Insurance P...

- – How do I compare Level Term Life Insurance F...

- – Who are the cheapest Term Life Insurance Wit...

The main differences in between a term life insurance policy policy and an irreversible insurance plan (such as whole life or universal life insurance policy) are the period of the plan, the accumulation of a cash worth, and the cost. The right choice for you will certainly rely on your demands. Right here are some things to consider.

Individuals who possess whole life insurance policy pay a lot more in costs for less coverage yet have the safety and security of understanding they are shielded permanently. Level term life insurance premiums. Individuals that get term life pay premiums for a prolonged period, however they get nothing in return unless they have the misfortune to pass away prior to the term expires

The performance of permanent insurance policy can be constant and it is tax-advantaged, offering added benefits when the supply market is unpredictable. There is no one-size-fits-all solution to the term versus permanent insurance debate.

The motorcyclist ensures the right to convert an in-force term policyor one ready to expireto an irreversible plan without experiencing underwriting or verifying insurability. The conversion biker need to allow you to convert to any type of permanent plan the insurance provider provides with no constraints. The primary functions of the motorcyclist are keeping the original wellness score of the term plan upon conversion (even if you later have health problems or become uninsurable) and choosing when and just how much of the coverage to convert.

What is a simple explanation of Level Term Life Insurance Vs Whole Life?

Of program, total costs will certainly enhance considerably because entire life insurance coverage is extra pricey than term life insurance coverage - Level death benefit term life insurance. Medical problems that develop throughout the term life period can not trigger costs to be enhanced.

Term life insurance coverage is a fairly cost-effective way to supply a round figure to your dependents if something happens to you. If you are young and healthy and balanced, and you support a household, it can be a good option. Whole life insurance policy comes with significantly higher regular monthly costs. It is indicated to provide insurance coverage for as lengthy as you live.

Insurance policy firms established an optimum age limit for term life insurance coverage plans. The costs also increases with age, so a person aged 60 or 70 will certainly pay substantially even more than a person years more youthful.

Term life is rather similar to cars and truck insurance. It's statistically unlikely that you'll require it, and the premiums are money down the drain if you do not. However if the worst happens, your family members will get the benefits.

How much does No Medical Exam Level Term Life Insurance cost?

A degree premium term life insurance policy plan allows you stay with your budget plan while you aid safeguard your household. Unlike some stepped price strategies that raises yearly with your age, this type of term plan uses rates that stay the exact same through you pick, even as you obtain older or your health and wellness modifications.

Discover more concerning the Life insurance policy options available to you as an AICPA member. ___ Aon Insurance Coverage Providers is the brand for the broker agent and program management operations of Affinity Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Policy Agency, Inc. (CA 0795465); in Alright, AIS Fondness Insurance Policy Services Inc.; in CA, Aon Affinity Insurance Coverage Providers, Inc.

Is Level Term Life Insurance Benefits worth it?

The Plan Representative of the AICPA Insurance Policy Trust, Aon Insurance Coverage Solutions, is not associated with Prudential. Group Insurance insurance coverage is issued by The Prudential Insurance Provider of America, a Prudential Financial business, Newark, NJ. 1043476-00002-00.

For the many component, there are two sorts of life insurance policy intends - either term or permanent plans or some combination of the two. Life insurance firms offer numerous types of term plans and standard life plans in addition to "passion sensitive" items which have come to be a lot more common considering that the 1980's.

Term insurance coverage provides defense for a given period of time - Level term life insurance policy. This duration might be as short as one year or provide insurance coverage for a specific variety of years such as 5, 10, two decades or to a specified age such as 80 or sometimes up to the earliest age in the life insurance policy mortality

What is a simple explanation of Affordable Level Term Life Insurance?

Presently term insurance policy rates are really competitive and amongst the most affordable traditionally knowledgeable. It ought to be noted that it is an extensively held belief that term insurance policy is the least pricey pure life insurance policy coverage offered. One needs to review the plan terms meticulously to make a decision which term life alternatives are ideal to meet your specific conditions.

With each new term the costs is raised. The right to restore the policy without evidence of insurability is a crucial advantage to you. Or else, the danger you take is that your wellness may degrade and you may be incapable to get a plan at the same prices or perhaps at all, leaving you and your recipients without coverage.

You must exercise this choice during the conversion period. The size of the conversion period will differ depending upon the sort of term policy acquired. If you convert within the proposed duration, you are not required to give any kind of information concerning your health and wellness. The premium rate you pay on conversion is normally based on your "existing acquired age", which is your age on the conversion date.

What are the top Level Term Life Insurance Protection providers in my area?

Under a degree term policy the face amount of the plan stays the exact same for the whole duration. Usually such policies are marketed as mortgage protection with the quantity of insurance coverage decreasing as the equilibrium of the mortgage decreases.

Traditionally, insurance firms have not had the right to alter premiums after the plan is marketed. Considering that such policies might proceed for several years, insurance firms must utilize traditional death, passion and expenditure rate price quotes in the costs estimation. Adjustable premium insurance policy, nonetheless, allows insurance companies to provide insurance coverage at lower "current" premiums based upon less traditional assumptions with the right to alter these premiums in the future.

While term insurance coverage is created to offer defense for a specified time duration, permanent insurance coverage is designed to offer coverage for your entire lifetime. To keep the costs rate degree, the costs at the younger ages exceeds the real cost of defense. This added premium develops a book (cash money value) which aids pay for the policy in later years as the cost of defense increases over the costs.

How do I compare Level Term Life Insurance For Families plans?

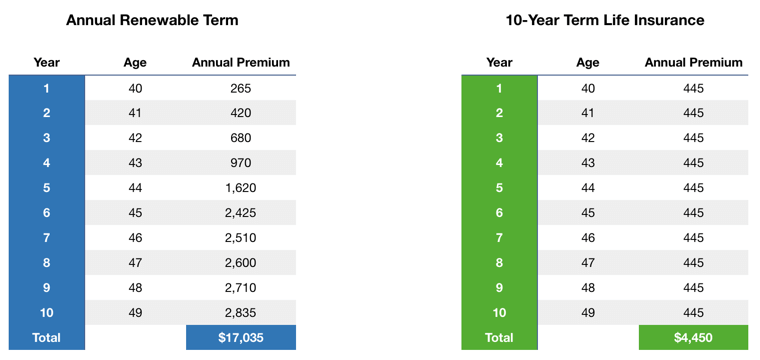

With degree term insurance, the cost of the insurance policy will remain the same (or potentially reduce if returns are paid) over the regard to your policy, typically 10 or 20 years. Unlike long-term life insurance coverage, which never ends as long as you pay costs, a degree term life insurance policy policy will end at some point in the future, commonly at the end of the duration of your level term.

Due to the fact that of this, lots of people make use of permanent insurance coverage as a stable monetary preparation device that can serve many requirements. You might have the ability to transform some, or all, of your term insurance policy throughout a collection period, generally the initial 10 years of your policy, without needing to re-qualify for insurance coverage even if your health and wellness has actually changed.

Who are the cheapest Term Life Insurance With Fixed Premiums providers?

As it does, you might wish to add to your insurance policy coverage in the future. When you initially get insurance, you may have little financial savings and a big mortgage. Ultimately, your savings will expand and your home loan will certainly shrink. As this happens, you might intend to at some point lower your death advantage or think about converting your term insurance policy to a long-term policy.

So long as you pay your premiums, you can rest simple recognizing that your enjoyed ones will certainly obtain a fatality advantage if you pass away during the term. Lots of term plans enable you the capacity to convert to permanent insurance without needing to take an additional health and wellness exam. This can enable you to capitalize on the extra advantages of a permanent policy.

Table of Contents

- – What is a simple explanation of Level Term Lif...

- – How much does No Medical Exam Level Term Life ...

- – Is Level Term Life Insurance Benefits worth it?

- – What is a simple explanation of Affordable Le...

- – What are the top Level Term Life Insurance P...

- – How do I compare Level Term Life Insurance F...

- – Who are the cheapest Term Life Insurance Wit...

Latest Posts

How Does Life Insurance Level Term Benefit Families?

What is Life Insurance Level Term? Key Facts

How can Legacy Planning protect my family?

More

Latest Posts

How Does Life Insurance Level Term Benefit Families?

What is Life Insurance Level Term? Key Facts

How can Legacy Planning protect my family?