All Categories

Featured

Table of Contents

Insurance provider will not pay a minor. Rather, think about leaving the cash to an estate or count on. For more in-depth details on life insurance policy obtain a duplicate of the NAIC Life Insurance Policy Buyers Guide.

The IRS puts a limit on just how much cash can go into life insurance policy premiums for the plan and just how swiftly such costs can be paid in order for the policy to maintain all of its tax obligation benefits. If particular limitations are surpassed, a MEC results. MEC insurance policy holders may go through tax obligations on distributions on an income-first basis, that is, to the extent there is gain in their policies, as well as penalties on any kind of taxed amount if they are not age 59 1/2 or older.

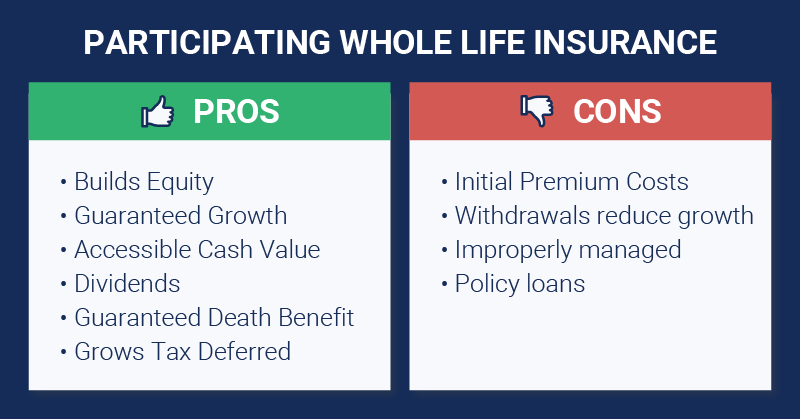

Please note that outstanding car loans accumulate interest. Income tax-free treatment likewise thinks the loan will eventually be satisfied from revenue tax-free survivor benefit profits. Fundings and withdrawals reduce the policy's money value and survivor benefit, may create certain plan advantages or bikers to come to be unavailable and might raise the possibility the policy may gap.

4 This is supplied through a Long-lasting Care Servicessm motorcyclist, which is offered for an added cost. Additionally, there are constraints and limitations. A client may get approved for the life insurance coverage, however not the motorcyclist. It is paid as a velocity of the fatality advantage. A variable universal life insurance policy agreement is an agreement with the main purpose of supplying a survivor benefit.

What is the most popular Beneficiaries plan in 2024?

These portfolios are carefully handled in order to satisfy stated financial investment purposes. There are costs and costs related to variable life insurance policy contracts, consisting of mortality and risk costs, a front-end lots, administrative fees, financial investment monitoring costs, surrender fees and charges for optional motorcyclists. Equitable Financial and its affiliates do not offer legal or tax guidance.

Whether you're starting a family members or getting married, individuals normally start to think of life insurance policy when someone else begins to rely on their capability to earn a revenue. And that's excellent, because that's precisely what the death benefit is for. However, as you discover more regarding life insurance policy, you're most likely to find that lots of policies for circumstances, entire life insurance policy have much more than just a survivor benefit.

What are the advantages of entire life insurance policy? One of the most attractive advantages of buying a whole life insurance plan is this: As long as you pay your premiums, your death advantage will certainly never expire.

Believe you do not require life insurance coverage if you don't have youngsters? You might intend to reconsider. It might feel like an unnecessary expenditure. There are lots of advantages to having life insurance, also if you're not supporting a family members. Below are 5 factors why you must buy life insurance policy.

Why is Senior Protection important?

Funeral expenses, burial prices and medical expenses can include up (Flexible premiums). The last point you want is for your enjoyed ones to bear this added problem. Irreversible life insurance is readily available in numerous quantities, so you can pick a survivor benefit that meets your demands. Alright, this set only applies if you have children.

Identify whether term or permanent life insurance coverage is ideal for you. As your individual circumstances change (i.e., marriage, birth of a child or task promo), so will your life insurance policy needs.

Generally, there are 2 types of life insurance policy plans - either term or irreversible plans or some combination of the two. Life insurance providers offer numerous forms of term strategies and typical life plans in addition to "interest delicate" products which have actually become much more prevalent since the 1980's.

Term insurance policy provides protection for a given period of time. This duration could be as short as one year or offer protection for a details variety of years such as 5, 10, 20 years or to a defined age such as 80 or in many cases as much as the earliest age in the life insurance policy mortality tables.

Death Benefits

Currently term insurance coverage prices are really competitive and amongst the most affordable traditionally seasoned. It should be noted that it is a commonly held idea that term insurance coverage is the least pricey pure life insurance policy coverage available. One requires to review the plan terms thoroughly to choose which term life choices appropriate to fulfill your particular conditions.

With each brand-new term the premium is boosted. The right to renew the plan without proof of insurability is an essential advantage to you. Or else, the threat you take is that your health and wellness might wear away and you might be unable to obtain a policy at the same rates and even in any way, leaving you and your recipients without coverage.

You need to exercise this option throughout the conversion duration. The size of the conversion period will vary depending on the kind of term plan bought. If you transform within the prescribed duration, you are not needed to give any kind of information about your wellness. The costs price you pay on conversion is generally based upon your "existing obtained age", which is your age on the conversion date.

Under a level term policy the face quantity of the plan stays the same for the whole duration. With reducing term the face amount decreases over the duration. The premium stays the same annually. Frequently such policies are sold as mortgage security with the amount of insurance policy decreasing as the balance of the home mortgage lowers.

How does Term Life Insurance work?

Commonly, insurance firms have not had the right to alter premiums after the plan is offered. Considering that such plans may continue for several years, insurance companies need to make use of traditional mortality, passion and cost price price quotes in the premium calculation. Flexible premium insurance, however, allows insurers to supply insurance at lower "present" premiums based upon less conventional assumptions with the right to change these premiums in the future.

While term insurance policy is developed to supply defense for a specified time duration, permanent insurance coverage is developed to give protection for your whole lifetime. To keep the costs price level, the costs at the more youthful ages goes beyond the real expense of defense. This extra premium constructs a book (cash money worth) which assists pay for the plan in later years as the cost of protection surges over the premium.

The insurance firm spends the excess premium bucks This type of policy, which is occasionally called cash worth life insurance policy, creates a cost savings component. Cash worths are essential to a long-term life insurance coverage plan.

Latest Posts

Life Insurance For Burial

Funeral Insurance For The Elderly

Funeral And Life Cover