All Categories

Featured

Table of Contents

Here are some sorts of non-traditional living advantages riders: If the policyholder outlives the term of their term life insurance policy, the return of costs rider ensures that all or part of the premiums paid are gone back to the policyholder. This can attract those who want the assurance of getting their cash back if the policy is never utilized.

The insurance company will either cover the costs or forgo them.: The guaranteed insurability cyclist allows the insurance holder to purchase additional insurance coverage at certain intervals without verifying insurability. Useful for those that prepare for needing more protection in the future, particularly useful for more youthful insurance holders whose needs might enhance with life occasions like marriage or giving birth.

How can I secure Living Benefits quickly?

Providing financial relief throughout the painful event of a youngster's death, covering funeral service expenditures, and allowing time off job.

Instead than concentrating on nursing homes or assisted living facilities, the Home Healthcare Rider offers advantages if the insured calls for home healthcare services. Enables people to get care in the convenience of their very own homes.

If the insurance policy holder comes to be unwillingly unemployed, this rider waives the costs for a specified period. Guarantees the policy does not lapse throughout periods of financial difficulty as a result of unemployment. It is necessary to comprehend the conditions of each rider. The cost, benefit quantity, duration, and details triggers vary widely amongst insurance coverage providers.

Not everyone is automatically qualified for life insurance coverage living benefit plan bikers. The particular qualification requirements can rely on numerous variables, consisting of the insurance coverage firm's underwriting standards, the kind and term of the policy, and the particular biker requested. Here are some usual aspects that insurers may consider:: Just particular kinds of life insurance policies might offer living benefits cyclists or have them included as conventional functions.

Is Life Insurance Plans worth it?

: Lots of insurance provider have age limitations when adding or exercising living benefits bikers. An essential illness rider could be available just to policyholders listed below a certain age, such as 65.: First qualification can be affected by the insured's health standing. Some pre-existing problems might make it challenging to get certain cyclists, or they might lead to higher costs.

:: An insurance policy holder could need to be detected with one of the protected critical illnesses.: The guaranteed could have to show they can not carry out a collection number of Tasks of Daily Living (ADLs) - Retirement planning.: A physician commonly must identify the policyholder with a terminal ailment, having actually a defined time (e.g., twelve month) to live

How do I get Riders?

A return of premium motorcyclist on a term policy might only be available if the insurance holder outlasts the entire term.: For specific motorcyclists, particularly those related to health, like the essential disease rider, extra underwriting could be required. This could involve medical examinations or thorough health surveys.

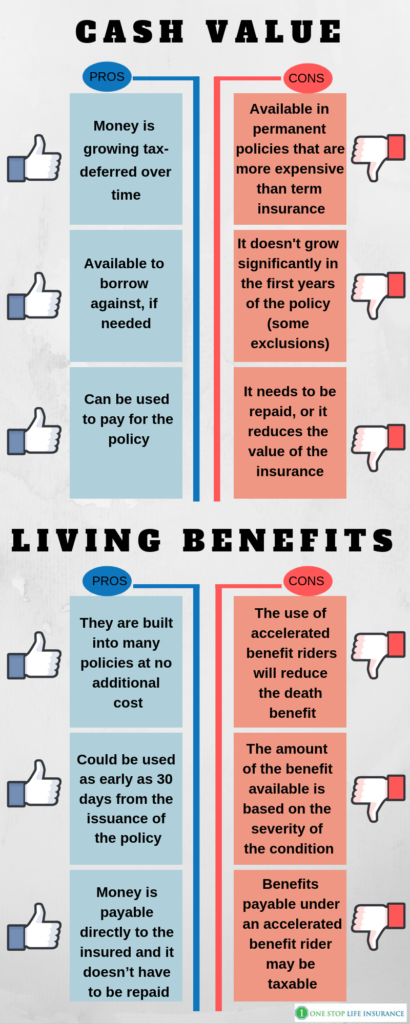

While life insurance with living benefits offers an included layer of protection and versatility, it's essential to be familiar with possible drawbacks to make a well-informed decision. Below are some potential disadvantages to consider:: Accessing living advantages generally suggests that the survivor benefit is minimized by the amount you withdraw.

How do I compare Premium Plans plans?

: Adding living benefits bikers to a policy might cause greater costs than a common policy without such riders.: There might be caps on the quantity you can withdraw under living advantages. Some policies may limit you to 50% or 75% of the death benefit - Flexible premiums.: Living advantages can introduce added intricacy to the plan.

While supplying a precise dollar quantity without specific details is challenging, here are the normal variables and considerations that affect the expense. Life insurance policy firms price their items in different ways based upon their underwriting standards and risk analysis versions. Age, health, way of life, occupation, life span, and whether or not you smoke can all affect the cost of a life insurance policy premium, and this lugs over right into the cost of a motorcyclist.

Whether living advantage cyclists deserve it depends on your circumstances, monetary goals, and danger tolerance. They can be a valuable addition for some individuals, but the extra cost might not be justified for others. Right here are a couple of considerations to assist figure out if it may be ideal for you:: If your family has a significant background of illnesses, an essential health problem biker might make more feeling for you.

Nonetheless, among the benefits of being guaranteed is that you make setups to put your life insurance policy in to a trust fund. This provides you better control over who will profit from your policy (the beneficiaries). You assign trustees to hold the money sum from your plan, they will certainly have discretion regarding which one of the beneficiaries to pass it on t, exactly how much each will certainly obtain and when.

How do I compare Universal Life Insurance plans?

Review much more about life insurance policy and tax obligation. It is necessary to remember that life insurance policy is not a cost savings or investment plan and has no money value unless a valid claim is made.

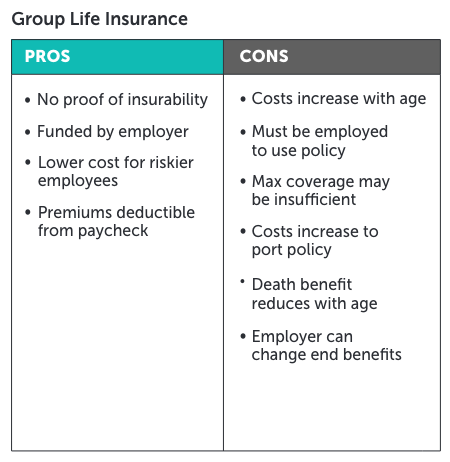

The company will help in working with any advantages that might be due. VRS has actually contracted with Securian Financial as the insurance firm for the Group Life Insurance Program.

If you were covered under the VRS Team Life Insurance Policy Program as a member, some advantages proceed right into retired life, or if you are qualified to retire but defer retirement. Your coverage will certainly finish if you do not satisfy the age and solution needs for retired life or you take a reimbursement of your member payments and interest.

The decrease price is 25% each January 1 up until it gets to 25% of the complete life insurance policy advantage value at retired life. If you contend the very least thirty years of service credit report, your protection can not lower below $9,532. This minimum will certainly be raised yearly based on the VRS Strategy 2 cost-of-living modification calculation.

How can I secure Death Benefits quickly?

On January 1, 2028, your life insurance coverage minimizes to $50,000. On January 1 complying with 3 fiscal year after your employment ends (January via December), your life insurance policy protection decreases a last 25% and stays at that value for the remainder of your retirement. Your last reduction will get on January 1, 2029, and your protection will certainly continue to be at $25,000 * for the rest of your retirement.

Latest Posts

Life Insurance For Burial

Funeral Insurance For The Elderly

Funeral And Life Cover